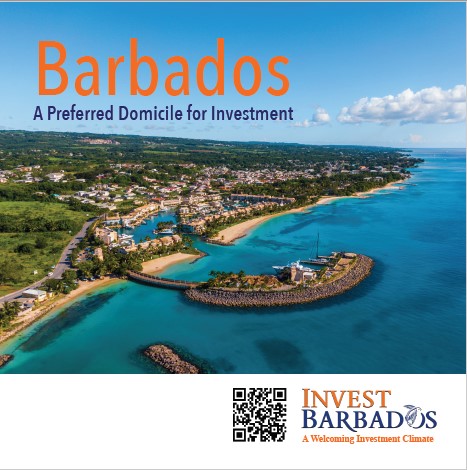

Invest Barbados

We are the investment promotion agency of Barbados. We will help you at every step of your investment journey with our personalised service offering expert advice, facilitation and more. Let us show you what Barbados can do for you.

Barbados

at a Glance

267,800

Population

GDP per capita. US$

18,150

99.6%

Literacy

English

Bajan

(English-based creole, widely spoken in informal settings)

(official)

Languages

(English-based creole, widely spoken in informal settings)

Get to know

Barbados

Let’s get acquainted. We are so much more than just an island in the sun – peel back the layers and Barbados will surprise you. From becoming a republic to Rihanna, modern Barbados boasts a vibrant culture, growing economy and enviable lifestyle.

The Barbados

Story

Learn more about our island and our people – where we’ve come from and where we’re going.

Investment

Opportunities

Our economy is strong and diversified with a range of thriving sectors from global financial services to biotech. Check out the full range of Barbados investment opportunities.

Medicinal Cannabis

From research to cultivation and export, be part of this multi-million dollar global industry.

Fintech

With a regulatory sandbox in place, Barbados offers many opportunities for Fintech investment.

Renewable Energy

With ambitious green targets, there’s a bright future for renewable energy in Barbados.

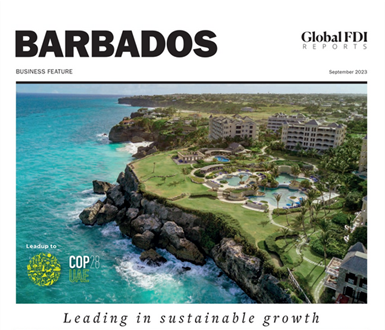

Niche Tourism

Beyond sun, sand and sea, our tourism product is innovative, experiential and sustainable

What’s

Happening